CA vs Accountant: Who Do You Actually Need for Your Business in India?

When running a business in India, one of the most confusing decisions for founders and business owners is:

👉 Should I hire a Chartered Accountant (CA) or just an Accountant?

Many people use these terms interchangeably — but they are not the same. Choosing the wrong professional can lead to compliance issues, penalties, and missed growth opportunities.

Let’s break it down clearly so you can make the right decision for your business.

Understanding the Difference: CA vs Accountant

Who Is a Chartered Accountant (CA)?

A Chartered Accountant is a highly qualified professional who:

- Is certified by the Institute of Chartered Accountants of India (ICAI)

- Clears rigorous exams (CA Foundation, Intermediate, Final)

- Completes mandatory articleship training

- Holds a Certificate of Practice (COP) to offer services

A CA is legally authorized to:

✔ Audit financial statements

✔ File income tax & GST returns

✔ Represent you before tax authorities

✔ Sign audit & compliance reports

Who Is an Accountant?

An Accountant is someone who:

- Maintains books of accounts

- Records daily transactions

- Prepares basic financial reports

They may have:

- A commerce degree

- Accounting software knowledge (Tally, Zoho, etc.)

- Practical experience

⚠️ Accountants are not regulated by ICAI and have limited legal authority.

Key Differences: CA vs Accountant (Quick Comparison)

| Aspect | Chartered Accountant (CA) | Accountant |

|---|---|---|

| Qualification | ICAI Certified | Degree / Experience Based |

| Legal Authority | Yes | No |

| Can Sign Audit Reports | Yes | No |

| Represent Before Tax Dept | Yes | No |

| Tax Planning | Advanced & Legal | Limited |

| Cost | Higher | Lower |

| Risk Handling | High | Low |

When Do You Need an Accountant?

An Accountant is suitable if your business:

✔ Is small or early-stage

✔ Has simple transactions

✔ Needs daily bookkeeping

✔ Requires invoice management

✔ Wants cost-effective data entry support

Best for:

- Small traders

- Freelancers

- Micro businesses

- Shops & local vendors

👉 Accountants help keep records organized, but cannot replace a CA for compliance.

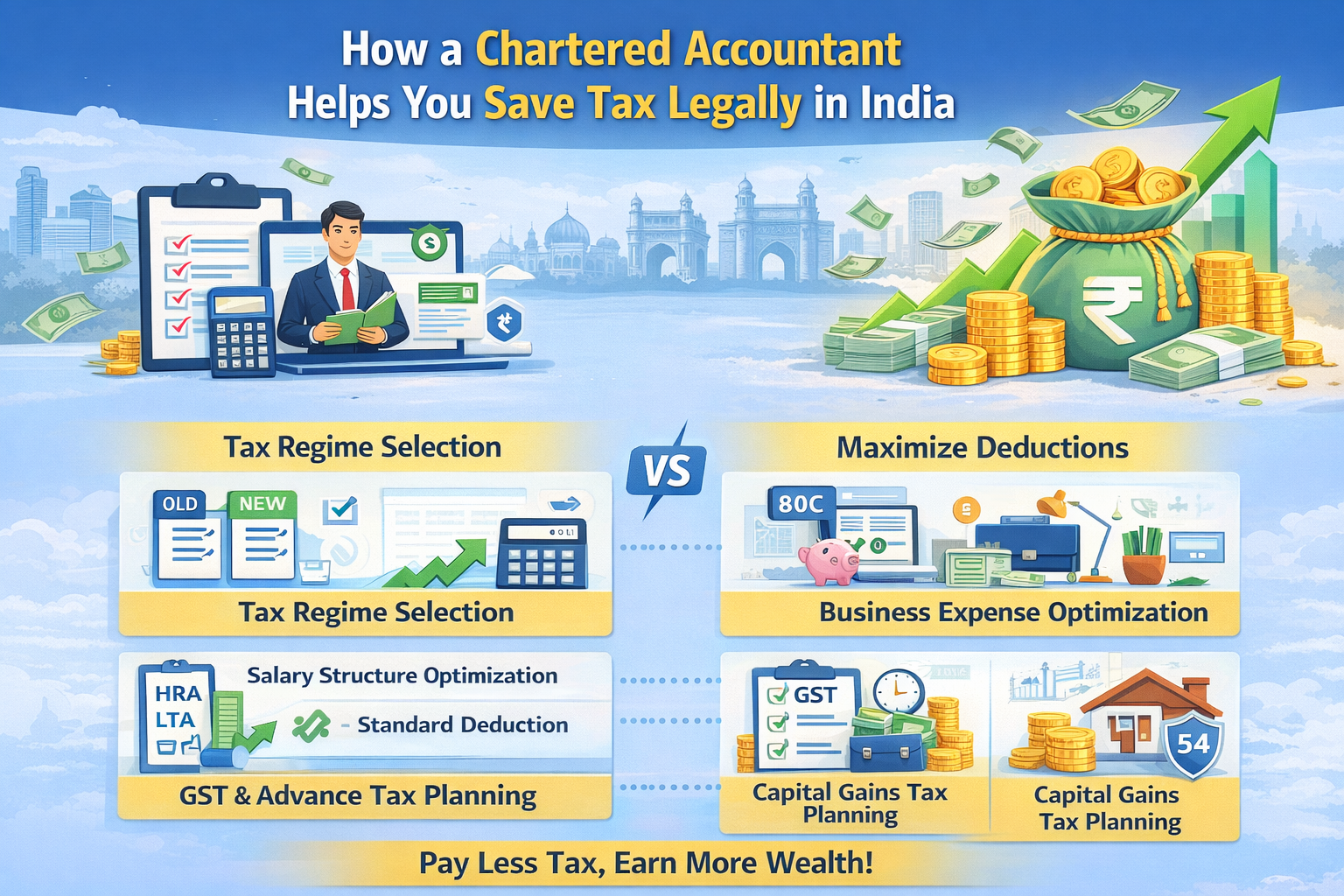

When Do You Need a Chartered Accountant?

You need a CA if your business:

✔ Needs GST filing or audits

✔ Requires income tax planning

✔ Receives tax notices

✔ Needs company compliance

✔ Is growing or scaling

✔ Wants legal tax savings

Best for:

- Startups

- Private Limited Companies

- LLPs

- MSMEs

- Funded businesses

- High-turnover firms

👉 A CA protects your business legally and financially.

Can You Use Both? (Best Practice)

Yes — and this is what smart businesses do.

Ideal Setup:

- Accountant → Daily bookkeeping & records

- CA → Tax filing, compliance, audits & planning

This combination:

✔ Reduces cost

✔ Improves accuracy

✔ Minimizes risk

✔ Ensures compliance

Common Mistakes Businesses Make

🚨 Depending only on an accountant for tax filings

🚨 Hiring unqualified “tax consultants”

🚨 Ignoring CA advice to save fees

🚨 Late compliance due to poor guidance

These mistakes often lead to:

- Penalties

- Legal notices

- Loss of credibility

- Financial stress

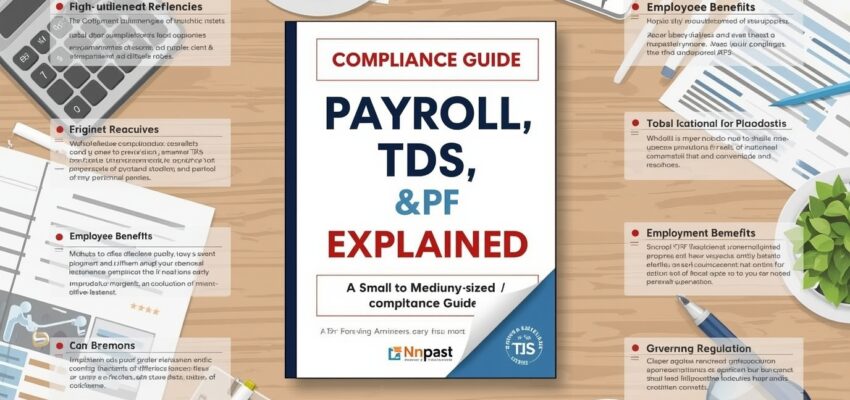

Cost Comparison: CA vs Accountant

- Accountant: ₹5,000 – ₹15,000/month (varies by city & scope)

- CA: Project-based or monthly retainer depending on services

💡 A CA may cost more, but the money they save you legally is often much higher.

How to Choose the Right Professional for Your Business

Before hiring:

✔ Verify ICAI registration (for CA)

✔ Check experience in your industry

✔ Ask about scope of services

✔ Ensure clear pricing

✔ Use verified platforms like Expenect

Final Verdict: CA or Accountant?

| Business Stage | Who You Need |

|---|---|

| Very Small / Early Stage | Accountant |

| Growing Business | Accountant + CA |

| GST Registered Business | CA |

| Company / LLP | CA |

| Tax Notices / Audits | CA |

| Scaling / Fundraising | CA |

👉 Accountants manage numbers.

CAs manage risk, compliance & growth.

Conclusion

If your business is serious about growth, compliance, and long-term stability, you cannot avoid a Chartered Accountant.

An accountant supports operations.

A CA safeguards your business future.

Looking for the Right CA for Your Business?

Explore Expenect and connect with ICAI-verified Chartered Accountants suited to your business needs.